Starting a small business out of your home, offering products or services like business consulting, photography, selling on the web or a MLM? You are now faced with tracking all your expenses and revenues for your business and you certainly don't have the money yet to engage a bookkeeper or accountant. If your business is a sole proprietorship, whether it be a Canadian Proprietorship or a US-based Proprietorship, you do not require an accountant to submit your company financials (books) to the IRS (USA) or Revenue Canada). Your business revenue and losses are reported as part of your annual personal income tax. For this small business start-up, you won't need to buy fancy accounting software, like Quick Books or AccPac to track your business.

Only as part of incorporating Bizfare Enterprise Inc in 2005 was it a requirement to engage an accountant. My accountant did insist on using Quick Books software for my business accounting. Up until then using a simple spreadsheet template served my business accounting needs for over ten years. This simple spreadsheet accounting stood the test of multiple audits by Revenue Canada (CRA and Revenue Canada Goods and Services Tax. Both the hardcopy columnar pad and an electronic spreadsheet version of my financial books were accepted by Revenue Canada. (BTW the audits disclosed more ways for me to claim back additional taxes for the previous three years! Now that's my type of audit!)

In your new start-up business venture, you likely will generate somewhere between 10 to 30 accounting transactions per month. These transactions would be items like Expense, Revenue (sales), Liability (Loan) type transactions and Sales Tax (Federal + State/Provincial) Collection/Deductions. These transactions are further broken down into various Business Accounts. All the Accounts you set up for your business is called a Chart of Accounts. Recording your business financial transactions (Journal Entries) can be executed with pen and ink on an accounting columnar pad or electronically with your computer using a spreadsheet program (MS Excel, Open Office, Star Office).

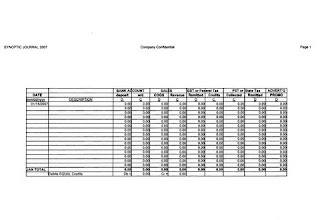

Whether you employ electronic or hardcopy media, you need to develop a simple Journal template to create your Business Synoptic Journal. This Synoptic Journal format has the advantage of allowing you a complete view of all your individual journal entry transactions against all your various Business Accounts. Creating this Synoptic Journal is easier to do than you think and requires no prior accounting or bookkeeping knowledge.

TIP #1: You could further reduce the accounting line items (Journal Entries) by consolidating like items such as 'all the Sales for the month' and 'all parking receipts for the month' into one totaled line item for the month.

Where do you start to identify the various Business Accounts required for your Synoptic Journal?

If you currently work for a company or government, secure of one of their employee expense forms. Look at each of the areas identified as expenses - meals, mileage, hotel accommodations, taxi, car rental, telephone & cell phone, air fare, office supplies, etc. This is an excellent place to identify the various Business Expense Accounts you need to set up for your business accounting books. To complete your business Chart of Accounts, include a Business Bank Account, Sales, COGS (Cost of Goods Sold), Sales Tax Collection, Marketing Expense and others as required. Each of these Accounts will be a listed as a title across the top of each column of your Synoptic Journal. Each row (line item) will be the individual journal transactions entered by you. The journal transactions are grouped and summarized for each business month; usually, January through December.

So your Synoptic Journal would look something like this Sample Synoptic Journal at http://picasaweb.google.com/carl.chesal/BookkeepingTemplate.

The column headings might be in this order (from left to right):

DATE | DESCRIPTION | BANK DEPOSITS | BANK WITHDRAWALS | SALES REVENUE | COGS | SALES TAX COLLECTED & REMITTED | OFFICE SUPPLIES EXPENSE | EXPENSE #2 | EXPENSE #3 | ETC

TIP #2: Unless your business is Incorporated or an LLC, you don't need to go through the expense of opening a business account with your bank. Usually Business accounts charge a higher monthly fee, charge for printing checks (cheques) and don't offer any interest on your monthly account balance. Instead, open a separate personal bank account (maybe savings). This will show the 'taxman' that you are keeping the business separate from your personal banking. Remember you are a sole proprietor and all your business income (and losses) are to be applied directly to your personal income tax submission ( a s per IRS and CRA).

To save you time and make is very simple, I have already created a simple spreadsheet Synoptic Journal template that performs all the calculations for each month and rolls up the 12 business months so it can easily be included in your annual personal income tax preparation. This Synoptic Journal template has Debit/Credit checks and balances, tracks sales taxes, mileage and totals each account for your entire fiscal year. If you want this FREE Bookkeeping template, you can get it at Communicate Innovate. With a few key strokes, which will help identify yourself, I will gladly send you this FREE Synoptic Journal Template and also any future Small Business Tips.

TIP #3: One Rule of Accounting is that every time you record a journal entry (line item which applies the transaction against the appropriate business accounts) the Debits and Credits MUST REMAIN EQUAL at ALL Times. This Debit Equals Credit calculator is built into this FREE Bookkeeping Template. When you have completed entering a line item (journal transaction), check to ensure that the amount the the Debit cell equals the amount in the Credit cell. If they are not equal, you have not entered the amounts properly in your journal transaction. Correct the problem before entering your next journal entry.

You are now equipped to capture your business financial books with some simple accounting software. Happy bookkeeping! And Happy Selling!

About the Author:

Carl Chesal is a business and channel development consultant, trainer, internet marketer and professional photographer. He operates BizFare Enterprise Inc, providing business, marketing, and internet marketing consulting services. Bizfare Enterprise also operates a number of secure on-line Professional Services sites, like Communicate Innovate.

1 comment:

The article of this blog very informative and useful also.It resolves many problems of mine.I loved it.thanks for this marvelous article...................

online jobs

Post a Comment